Managing payroll is one of the most challenging tasks for HR teams. It’s more than just paying employees the compensation stipulated in their contracts. In reality, it involves a complex set of processes spanning calculations, compliance, and issuance.

But even though payroll isn’t a linear process, it doesn’t mean it can’t be streamlined. Before exploring ways to optimize your enterprise’s payroll process, let’s run through the common payroll systems and identify the best solution for your enterprise.

Types of Payroll Systems for Businesses

1. Manual In-House Payroll

Small businesses typically process their payroll manually. It can be handled by an internal HR department or an in-house accountant. Manual payroll processes may make the most sense when you manage a small team as there are fewer documents to deal with. You can use your company’s timesheet documentations to compute your team’s earnings against their total working hours.

However, when you account for tax calculations and mandatory contributions, manual payroll systems can be a pain. These deductions require heavier calculations and more paperwork. If your HR team is already overwhelmed by other responsibilities, payroll processing can take a while, potentially leading to delayed disbursements.

Manual payroll processing also becomes a hassle when your team grows. With more people to manage, computing salaries and wages manually will take more time and effort. To know if your business should stick to an in-house manual payroll system, here are the pros and cons to note:

Pros:

- Cost-effective option for small businesses with 10-50 employees

Cons:

- Time-consuming and prone to errors

- Limited security

- Not as scalable as automated systems

With more cons than pros, manual payroll systems are generally not advisable. Despite having no upfront costs, it could cost your business more in the long run, especially when your workforce grows. It’ll be wise to consider either outsourcing your payroll or switching to an automated payroll system in the future.

2. Outsourced Payroll

Outsourcing your payroll process, a third-party company or accountant manages your enterprise’s payroll process. Small businesses or startups that are not yet ready to adopt automation should consider this option.

Managed payroll services take a significant burden out of your HR team’s hands. The right provider can craft a payroll system tailored to your workforce and handle regulatory filings, leaving you assured that your employees are always paid correctly and on time.

For your company’s part, you just need to provide your workforce’s data and pay for the services agreed upon. However, you’re still responsible for ensuring complete payroll accuracy and compliance.

If you’re considering managed payroll services, here are the pros and cons to note:

Pros:

- Saves time and money on manual processes

- Suitable for SMBs

- Expertly handled payroll

- Can be tailored to your workforce

- You can leverage more advanced tools your company doesn’t have in-house

Cons:

- Can be expensive depending on the scope of services you require

- Payroll data may not be instantly accessible

Outsourcing is a more efficient way to process payroll than doing it manually. Get in touch with a managed payroll provider to tailor the perfect payroll system for your growing business.

3. Automated Payroll

With an automated system, enterprises can eliminate manual payroll processes by 90% and experience more secure and timely disbursements. Powerful payroll software can set up workflows based on your workforce instead of a cookie-cutter model that may not fit some organizations. Such software would also automatically apply mandatory contributions to every payslip, ensuring complete compliance.

Payroll software can also be integrated with attendance and ERP systems to ensure that your team’s payroll calculations are in sync with their attendance or output. Furthermore, automated payroll software is highly configurable and scalable, growing with your team and costing less the more your workforce expands.

Considering all of these, automated payroll is easily the best system for enterprises. But you should still weigh the pros and cons before investing.

Pros:

- Time and cost-efficient

- Hyper-flexible; can be tailored according to your workforce’s needs

- Can be cheaper than managed payroll services

- Deposits compensation straight into your team’s bank accounts

- Guaranteed compliant

- Doesn’t require additional IT infrastructure

- More secure than manual systems

- Compatible with numerous HRMS and ERP software

Cons:

- Upfront costs can be expensive

- Not all providers have strong customer support

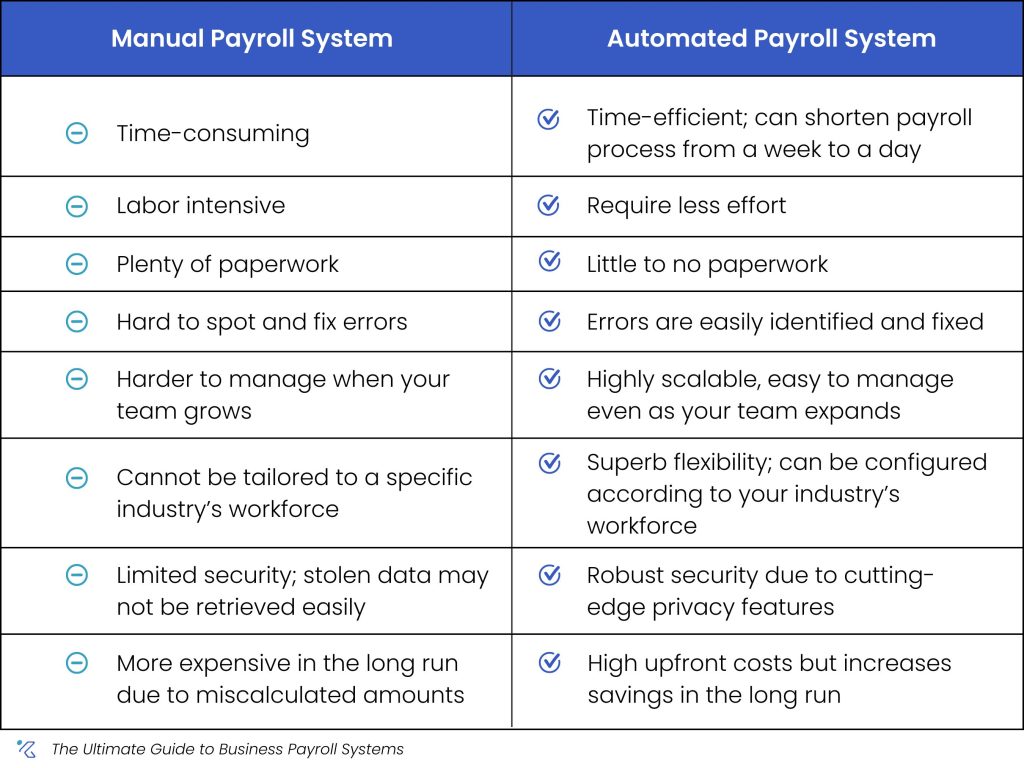

Manual vs. Automated Payroll Systems: Which one to choose?

Automated systems are especially targeted at businesses struggling with inefficiencies brought by manual processes, or those using disjointed systems that make payroll tasks more complicated than they should be.

However, it is important to note that you don’t need a large workforce to leverage payroll software. Hyper-flexible systems, like KAMI’s Payroll feature, can be tailored to any workforce size with its scalable features.

The comparison chart below outlines the common issues with manual payroll and how automated systems combat them:

What to Consider Before Automating Your Business’ Payroll System

Migrating all payroll paperwork and processes to the cloud can feel daunting, and it’s definitely a decision you shouldn’t make without thorough consideration. To aid you in your decision-making process, we’ve rounded up the top factors you should consider before automating your payroll.

1. Workforce Size

Small companies looking to automate systems are often hindered by one thing: Budget. As such, they’re forced to go with cheap and generic off-the-shelf software that doesn’t actually fit their business.

Overlooking such issues is a factor on why 42% of HR tech implementations fail. Less powerful payroll software are also typically incompatible with other HR platforms or lack compliance features. Hence, they lead your business to the opposite of what you’re aiming for, ultimately costing you more time and money.

Look for payroll software that can be tailored to your workforce’s size to maximize your investment’s value. Robust, enterprise-grade payroll software is especially engineered to streamline the processing of thousands of payslips, integrates seamlessly with other HR and ERP platforms, and unifies your workforce data in one, secure place.

2. Integrations

Your convenience and time-savings will be doubled if your payroll software can integrate with your other HR systems, like attendance, for example. That way, your team’s pay is automatically calculated based on their worked hours within a particular cut-off. You can also automatically apply rates for overtime or holiday work.

Integrating payroll software with an expense management system is also an advantage. This helps you apply expense reimbursements to your employees’ payslips.

Additionally, an automated payroll system that connects with accounting software is a plus. Syncing accounting records with payroll data eliminates the hassle of manual reconciliation, which involves vast amounts of data for large enterprises.

With your HR, accounting, and accounting systems unified, your workflows go more smoothly and your entire team will feel the positive impact.

3. Compatible Devices and Offline Functionality

Payroll software shouldn’t just be accessible through a PC. You’re better off choosing a device-agnostic system so it’s more easily accessible for your entire workforce. Even if admin functions are only available on a certain device, your team can at least access their payroll records through their smartphones, for example.

Powerful automated payroll systems should also have an offline mode. Although the functions might be limited, any new data can sync back into the cloud once your internet connection is restored.

4. Flexibility

What’s your payroll schedule? If you pay your employees twice a month, your payroll software should be configurable to this set-up. Not only that, but it should also support various payroll frequencies, which is essential if you have employees that get paid weekly, bi-weekly, or daily.

Several industries have diverse payroll setups, so make sure to choose an automated payroll system that enables various pay schedules.

5.Customer Support

Whether you’re new or experienced in using HR systems, you deserve a provider with a responsive customer support team. They’re not just there to help you solve issues, but they also help you navigate your system and keep you updated on any improvements.

One way to research an HRMS’ customer support team is checking out online and app reviews. Focus on providers praised for their attentiveness, swift action, and patience.

Empower Your Business With a Tailored Payroll System

As one of the most tedious yet crucial HR processes, payroll should be among the first areas to look into when considering innovation. If you’re not yet ready to embrace sophisticated HR tech, managed payroll services is the next best option.

On the other hand, if you’ve been looking for a flexible and scalable payroll solution, consider KAMI Workforce. Our payroll system’s wealth of features allows you to craft a payroll system that fits your business like a glove, and guarantees robust integration and compliance.